Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsGlobal banking rules are failing emerging markets

Building resilient and sustainable economies will require transformational investments across the developing world in infrastructure, technology, health and education.

Change text size

Gift Premium Articles

to Anyone

I

n an era of shrinking resources for development finance, global policymakers must shift their focus to making better use of existing funds. Identifying and removing regulatory barriers that hinder the efficient deployment of capital to emerging markets and developing economies (EMDEs) is a good place to start.

The Basel III framework, developed in response to the 2008 global financial crisis, has played a crucial role in preventing another systemic collapse. But it has also inadvertently discouraged banks from financing infrastructure projects in EMDEs.

At the same time, advanced economies, with debt-to-gross domestic product ratios at historic highs, face mounting fiscal pressures. Servicing these debts consumes a growing share of public budgets just as governments must ramp up defense spending and boost economic competitiveness, resulting in cuts to foreign aid.

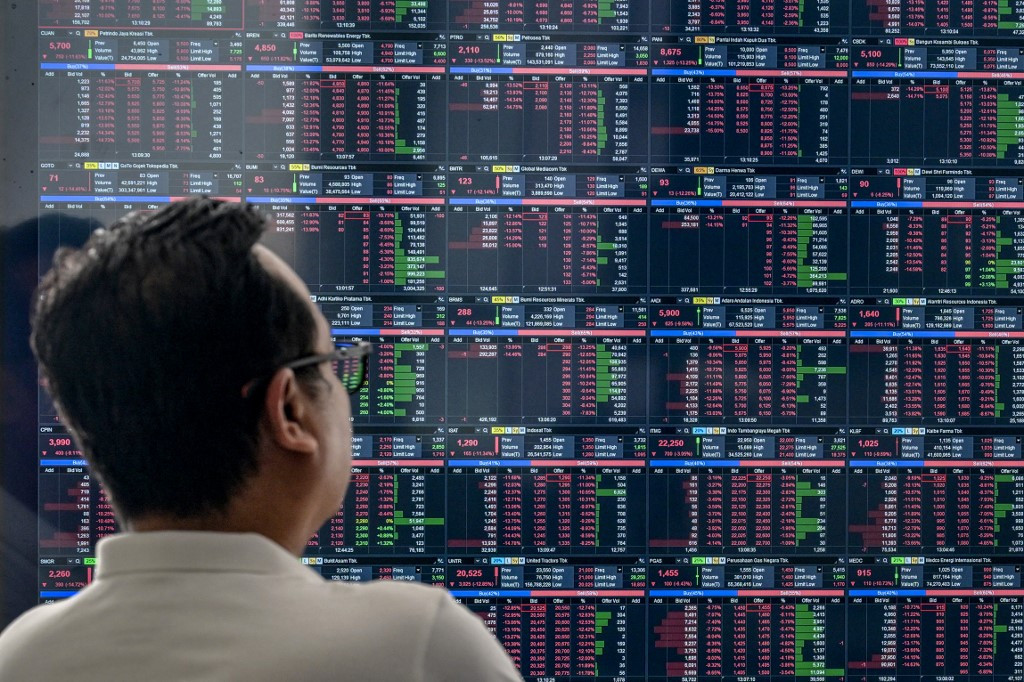

Together, these pressures underscore the urgent need to mobilize more private capital for investment in EMDEs. Building resilient and sustainable economies will require transformational investments across the developing world in infrastructure, technology, health and education.

According to the United Nations Conference on Trade and Development (UNCTAD), EMDEs must raise more than US$3 trillion annually beyond what they can raise through public revenues to meet critical development and climate targets.

Amid these challenges, prudential regulation impedes the ability of EMDEs to raise private capital. This issue can be traced back to the global financial crisis, which wiped out $15 trillion in global GDP between 2008 and 2011. Since the crisis stemmed from weak capital and liquidity controls as well as the unchecked growth of innovative and opaque financial products, Basel III was designed to close regulatory loopholes and bolster oversight, particularly in response to the rise of the non-bank financial sector.

While the revised framework addresses the vulnerabilities that triggered the 2008 crisis, its focus on advanced economies and systemically important financial institutions inadvertently imposes several requirements that restrict capital flows to EMDEs.